Do you buy and sell crypto?

Are bitcoin, litecoin, ethereum or ripple in your investment portfolio?

Whether you’ve dabbled in trading them, or you are 100% in on crypto, Australia has strict tax legislation that covers the taxation of CGT assets including crypto. The Australian Tax Office (ATO) has issued guidance for investors that you should follow. Of course guidance is only general in nature and specific circumstances can dictate a different approach to your tax.

It’s not just about compliance. These rules also determine the tax implications around your earnings and gains, which is why you need a crypto tax accountant to help you get the most out of your investment.

But, is your current accountant up to date enough to help you?

Effective crypto tax reports by a crypto accountant

Even with the right tools and the right qualifications, it’s not easy to account for digital currency investments and perform tax calculations that actually meet Australia's tax legislation.

However, at Kova Tax, we specialise in (and love) crypto.

That's why we’ve developed a crypto tax reporting service for investors and traders like you. Our tax reports can be used by your existing accountant or you can lodge your tax return directly with us.

This way, you know your tax obligations have been met and you’re getting the best result, based on your crypto investments.

Our crypto tax reports can be used by:

How can we help?

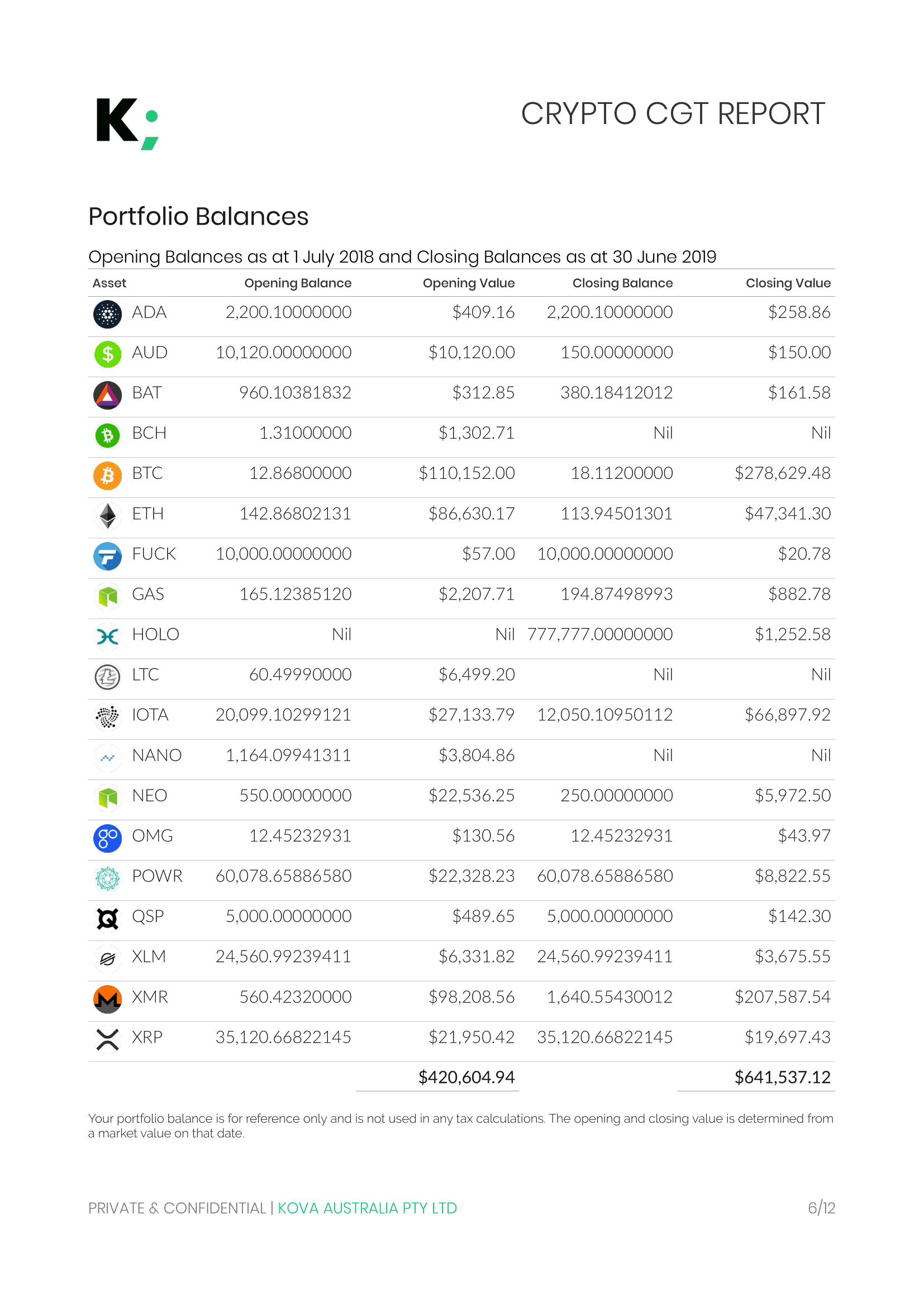

Your crypto tax report

Your crypto tax report is prepared by a qualified crypto accountant experienced in digital assets.

Trade Anywhere

We handle your trading activity across all platforms, no matter how exotic the trading exchanges or services you used.

Comprehensive Tax Report

We aggregate your trading activity across all locations and consolidate into a single report. Helping you to understand your actual tax position and outcomes.

Tax Treatment

Your crypto activity is categorised for investor vs trader. We also take into account the nature of the digital assets you have actually been trading, whether they are CGT assets, CFDs or other financial instruments.

We work with all of these platforms and more

We handle your crypto activity across all the common exchange platforms and are well positioned to handle less-common platforms and services on request.

Pricing

Our pricing scales with the quantity and complexity of your trading, meaning you always gets a high quality result that you can rely on. If you are a high volume trader we understand you likely have 10,000s to 100,000s of trades, please get in contact for a customised quote.

Bring your own Crypto Tax Report

If you would like to save on fees, than you can prepare your own crypto tax report which we'll use when lodging your tax return. If you are preparing your own crypto tax report, than we recommend using Australian crypto tax software Syla.- Prepare and lodge tax return

- Pay in fiat, BTC or ETH.

What's not included:

- Support to collect records

- Professional transaction reconciliation

Comprehensive

You will receive full support from our specialised crypto accounting team. We'll assist you to get all your transaction records together, reconcile your transactions, optimise for lower tax and complete your tax return.- Prepare and lodge tax return

- Pay in fiat, BTC or ETH.

- Tax optimisation

- Support to collect records

- Professional transaction reconciliation

- Australian software

- Exclusive tax optimisation

- Designed by Tax Professionals

Process

There is a simple process that we follow for every crypto tax report that we generate.

Collect

You export your data from all trading services and exchanges. We need a complete history of your transactions including:

- deposits and withdraws to and from the platform.

- trades and exchanges from one asset to another.

- lending income or expenses.

- any other income earned or expenses incurred.

- dated snapshot of your current balances to ensure your portfolio balances correctly reconcile.

- wallet addresses used for holding digital assets.

- details on any stolen or lost tokens as well as any insolvent projects.

- details on any OTC transactions.

- details on any other on-chain investments, expenses or income.

Upload

One you have collected all of your data, you can upload or email your data through to us. We will process everything and let you know if anything else is needed.

Report

We will prepare your crypto tax report and send you a final copy. We can also lodge your income tax return if needed.

Order your crypto tax report

Building a better digital world

Kova Tax is a tech-driven accounting firm building a better digital world for crypto SMSFs, businesses and individuals. Our accountants are not just skilled professionals, but also passionate investors in the digital asset space. Kova Tax is a corporate member of Blockchain Australia and participates in the Tax Working Group where we are driving positive legislative changes in this sector. We are published in the Institute of Public Accountants for our work on digital assets and present at a number of industry conferences throughout the year. We are Australia’s first accounting firm to enable all of our employees to be paid in bitcoin and we accept crypto as payment for our services. We are driven to building a better digital world.

Frequently Asked Questions

What if my crypto was lost, stolen or scammed?

Stolen or scammed crypto assets can be 'written-off' by acknowledging the disposal. We clearly detail any stolen, scammed or permanently lost assets that you advise us of in your report. You should collect substantiation for the write-off, the best documentation being a liquidators report, but acknowledgement of the event from a reputable news source may also be acceptable.

The exchange I was trading on is now insolvent and I can't get my records

The legislation is clear that you still have an obligation to keep the records. You should contact the support email or the liquidator and request a copy of your transactions. If unsuccessful, we have a number of data reconstruction techniques we can apply to ensure a best-effort approach is still achieved for your tax.

I have 100,000s of trades, can you still help?

Yes, we work with many clients that employ automated trading strategies and regularly reach into the 100,000s of executed trades. We automate the data processing and tax calculations which allow us to handle even the most frequent traders.

Can you handle this exotic platform I traded on once?

In general we can process your crypto activity from any platform or service, provided you have complete transactional data available that is reliable and accurate. The transactions we require are transfers into and out of the service, trades or exchanges from one asset to another and the details of any income earned and expenses incurred on the platform.

I am not sure if I am considered an investor or a trader?

If you trade frequently and you earn your primary income from trading activity, you may be a trader. We will provide you with an Income Report if you are a trader or other business entity.

What about my mining / staking rewards?

We can recognise your mining or staking income from on-chain transactions or from records provided by you. Your mining and staking rewards will be recognised as income. Once acquired, the assets may be treated as an investment asset or as trading stock depending how you conduct your activity.